Personal Financial Statement Template

This personal financial statement template is a great tool to keep track your personal assets, liabilities, income and expenses. A personal financial statement is a document or set of documents that outline an individual’s financial position at a given point in time. It is usually composed of two sections: a balance sheet section and an income flow section.

Although an individual can use more complex personal financial statements, this article will focus on a simple version. The format outlined in this article is a good starting point for individuals who are new to using personal financial statements to record their personal finances.

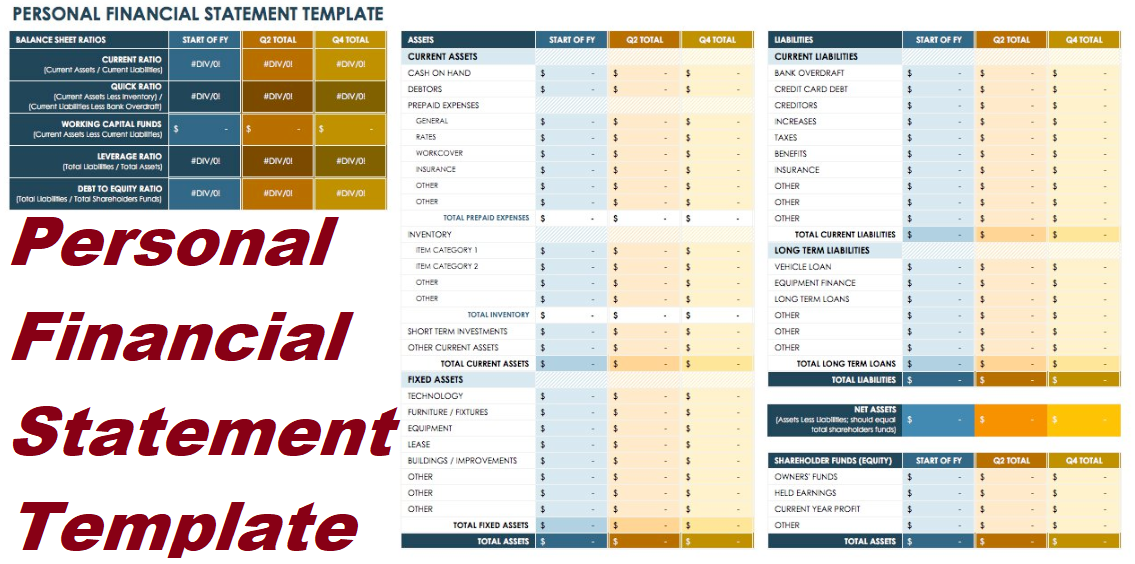

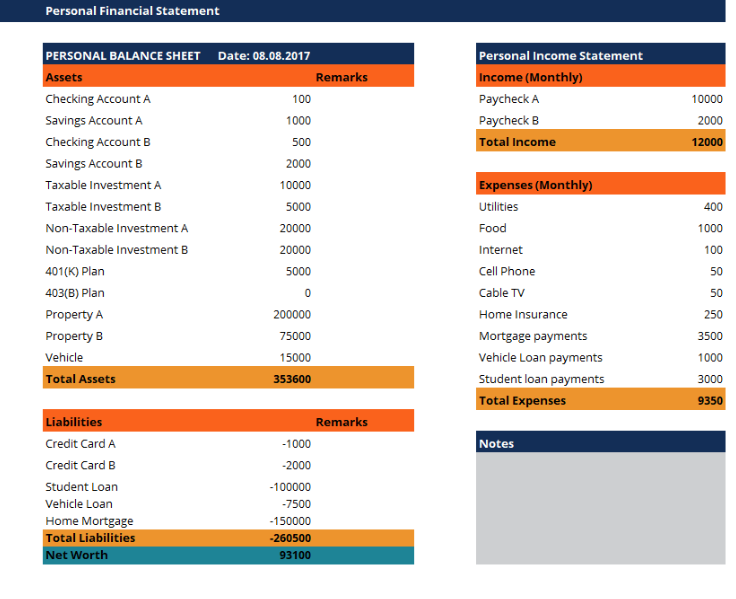

This is what the personal financial statement template looks like:

Personal Financial Statement Template Excel

Creating and maintaining your own Personal Financial Statement is useful for 4 main purposes: (1) Gaining a good financial education, (2) Creating and evaluating your budget, (3) Applying for business loans, and (4) Applying for personal loans.

If you already know why you need one, and why you want to use Excel to create one, then go ahead and download the template below. If you’d like to learn more about it, continue reading this page.

Description

This spreadsheet allows you to create and update an all-in-one personal financial statement that includes:

- Personal Balance Sheet – for listing assets and liabilities and calculating net worth.

- Cash Flow Statement – for listing all your inflows and outflows and calculating your net cash flow.

- Details Worksheet – for listing individual account balances and the details for your properties and loans.

- Info Sheet – for listing contact info that is typically required in loan applications (e.g. names and addresses of the applicant and co-applicant).

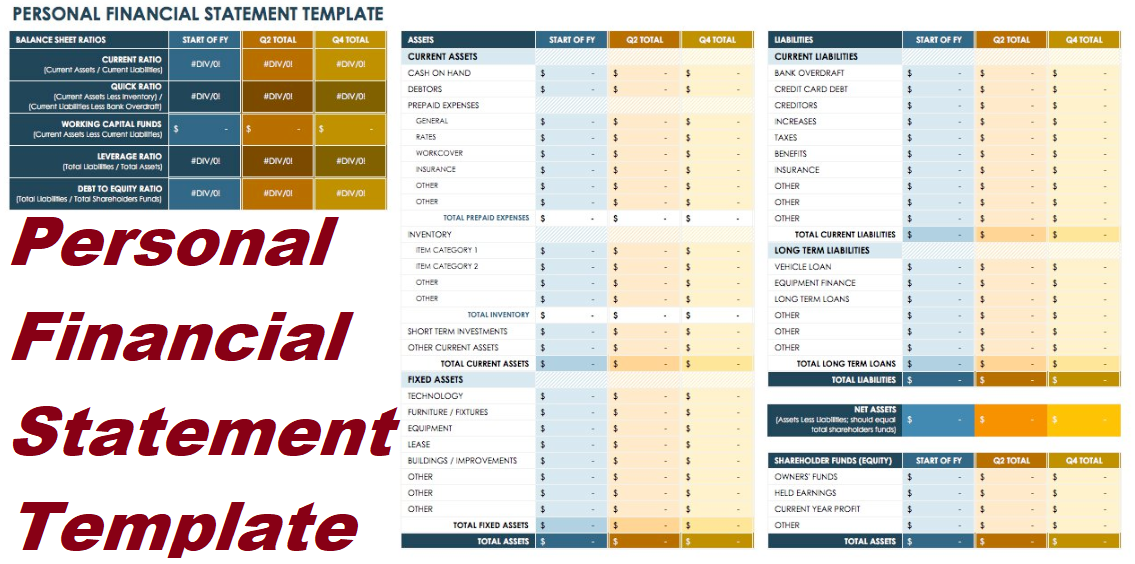

It also includes calculations for some common financial ratios:

- Basic Liquidity (BLR) Ratio = Total Liquid Assets / Total Living Expenses :: How many months can you live on your liquid assets without any income? This ratio uses info from both the balance sheet and the cash flow statement. It’s one of the really cool things that your PFS can tell you.

- Debt-to-Income (DTI) Ratio = Annual Debt Payments / Annual Income :: A ratio commonly used by lenders to determine how risky of an investment you will be. It should be below about 35% to be considered to have an acceptable level of debt. This comes from the cash flow statement.

- Debts-to-Assets Ratio = Total Liabilities / Total Assets :: Indicates the degree of leverage that is used by a person or company to finance their assets. The higher this ratio the less financial flexibility you have. This comes from the balance sheet.

What Is A Personal Financial Statement Template?

Your personal financial statement should show only your personally held assets and liabilities (Debts) outside the business. Do not include any business assets or liabilities.

Page 2 of the spreadsheet allows you to give the details behind the numbers on the balance sheet.

If you present this financial statement to a potential lender or investor, be sure to sign and date it in the space provided. The signature is your pledge that the statement is complete and accurate to the best of your knowledge.

Step 1: Prepare a list of all assets owned whether they are paid for or not. Enter the amount you would receive by selling the asset for cash.

Step 2: Prepare a list of liabilities (money you owe).

Step 3: Net worth = Total Assets – Total Liabilities

Two Reasons Why You Should Use Personal Financial Statement Templates

- They are cheap. In fact, you get any of the templates in this thread with a single click of a mouse. Because you get these file for free, there is no real reason why you should create them from scratch.

- The design does not require editing. Of course, creating the layout of the document is what often consumes a lot of time. At the end of the day, you end up spending a lot of time creating these files and then starting to write your statement. But doing all this is unnecessary. All you have to do is to download a template, and then use it to fill out your data.

Why do you need to write a Personal Financial Statement?

- To account for the money you spend in a given period. Knowing how much you spend and what you spend the money on will help you analyze your spending habits easily.

- You write a personal financial statement for your business to keep an accounting record of your business’ performance. At the end of the day, it is important to analyze the finances of your business to study the financial progress of your business.

- You should have this statement so that you can optimize your spending habit. Of course, a personal statement is almost always used for this purpose. And writing one is the only best way to help you determine how you spend.

It is important to remember that preparing a Personal Financial Statement is not a one-day job. You will need to do this every day so that you know how much you are investing and how much you are getting from your investment. If you are using the templates to track your spending habits, you will also find them helpful for optimizing your spending overall.