A common solvency ratio utilized by both creditors and investors is the times interest earned ratio. Often referred to as the interest coverage ratio, the times interest earned ratio depicts a company’s ability to cover the interest owed on debt obligations, expressed as income before interest and taxes divided by interest expense.

The ratio is stated as a number instead of a percentage, and the figures necessary to calculate the times interest earned are found easily on a company’s income statement. For example, a ratio of 5 means the business can meet the total interest payments owed on its outstanding, long-term debt five times over or that the business income is five times higher than the interest expenses owed for the year.

A higher times interest earned ratio is favorable because it means that the company presents less risk to investors and creditors in terms of solvency. From an investor or creditor’s perspective, an organization with a times interest earned ratio greater than 2.5 is considered an acceptable risk. Companies with a times interest earned ratio of less than 2.5 are considered a much higher risk for bankruptcy or default and, therefore, financially unstable.

Although a higher times interest earned ratio is favorable, it does not necessarily mean that a company is managing its debt repayments or its financial leverage in the most efficient way. Instead, a times interest earned ratio far above the industry average points to misappropriation of earnings. This means the business is not utilizing excess income for reinvestment through expansion or new projects but instead paying down debt obligations too quickly. A company with a high times interest earned ratio may lose favor with long-term investors.

What is the Times Interest Earned Ratio?

The Times Interest Earned (TIE) ratio measures a company’s ability to meet its debt obligations periodically. This ratio can be calculated by dividing a company’s EBIT by its periodic interest expense. The ratio shows the number of times that a company could, theoretically, pay its periodic interest expenses should it devote all of its EBIT to debt repayment.

The TIE’s primary purpose is to help quantify a company’s probability of default. This, in turn, helps determine relevant debt parameters such as the appropriate interest rate to be charged or the amount of debt that a company can safely take on.

A high TIE means that a company likely has a lower probability of defaulting on its loans, making it a safer investment opportunity for debt providers. Conversely, a low TIE indicates that a company has a higher chance of defaulting, as it has less money available to dedicate to debt repayment.

How to Calculate the Times Interest Earned Ratio

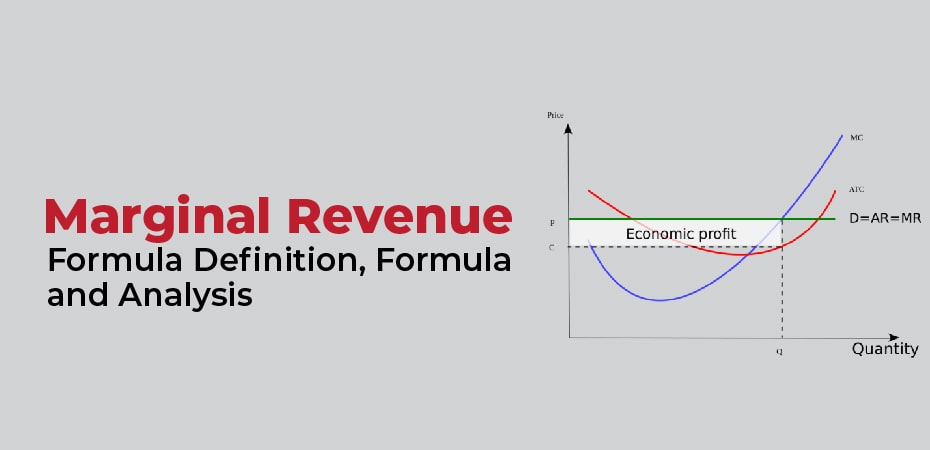

The Times Interest Earned ratio can be calculated by dividing its earnings before interest and taxes (EBIT) by its periodic interest expense. The formula to calculate the ratio is:

Where:

Earnings Before Interest & Taxes (EBIT) – represents profit that the business has realized without factoring in interest or tax payments.

Interest Expense – represents the periodic debt payments that a company is legally obligated to make to its creditors.

Generally speaking, the higher the TIE ratio, the better. However, a company with an excessively high TIE ratio could indicate a lack of productive investment by the company’s management. An overly high TIE suggests that the company may be keeping all of its earnings without re-investing in business development through research and development or pursuing positive NPV projects. This may cause the company to face a lack of profitability and challenges related to sustained growth in the long term.

Times Interest Earned Ratio Example

Harry’s Bagels wants to calculate its times interest earned ratio to understand its debt repayment ability better. Below are snippets from the business’ income statements:

The red boxes highlight the critical information we need to calculate TIE, namely EBIT and Interest Expense. Using the formula provided above, we arrive at the following figures:

Here, we can see that Harrys’ TIE ratio increased five-fold from 2015 to 2018. This indicates that Harry’s is managing its creditworthiness well, as it can continually increase its profitability without taking on additional debt. If Harry’s needs to fund a major project to expand its business, it can viably consider financing it with debt rather than equity.

To better understand the business’s financial health, the ratio should be computed for several companies that operate in the same industry. Suppose other firms operating in this industry see TIE multiples that are, on average, lower than Harry’s. In that case, we can conclude that Harry’s is doing a relatively better job managing its degree of financial leverage. In turn, creditors are more likely to lend more money to Harry’s, as the company represents a comparably safe investment within the bagel industry.

Factoring in Consistent Earnings

As a rule, companies that generate consistent annual earnings are likely to carry more debt as a percentage of total capitalization. If a lender sees a history of generating consistent earnings, the firm will be considered a better credit risk.

Utility companies, for example, generate consistent earnings. Their product is not an optional expense for consumers or businesses. Some utility companies raise 60% or more of their capital by issuing debt.

On the other hand, startups and businesses that have inconsistent earnings raise most or all of the capital they use by issuing stock. Once a company establishes a track record of producing reliable earnings, it may begin raising capital through debt offerings as well.