Depreciation Expense

It is important to analyze how company’s use depreciation, which can represent a significant portion of the expenses on a firm’s income statement, and which can impact the value of an investment opportunity in the short term. While there are rules governing how to expense depreciation, there is still plenty of wiggle room for management to make creative accounting decisions that can mislead investors. It pays to examine depreciation closely.

Companies tend to work hard to make sure their fundamentals look good to investors and analysts. So it’s essential to exercise good judgment when examining numbers that appear on financial statements. It’s not enough to know simply whether a company has, say, great-looking earnings per share (EPS) or a low book value. Investors need to be aware of the assumptions and accounting methods that produce those figures.

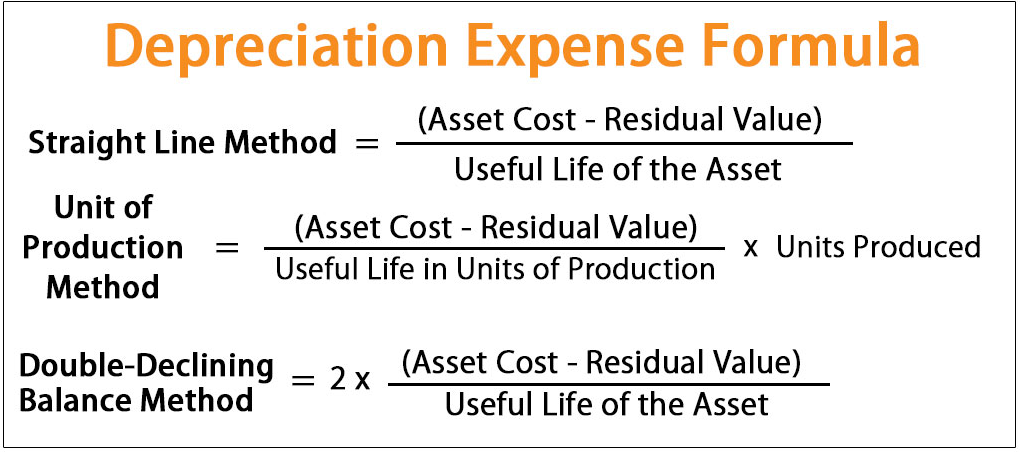

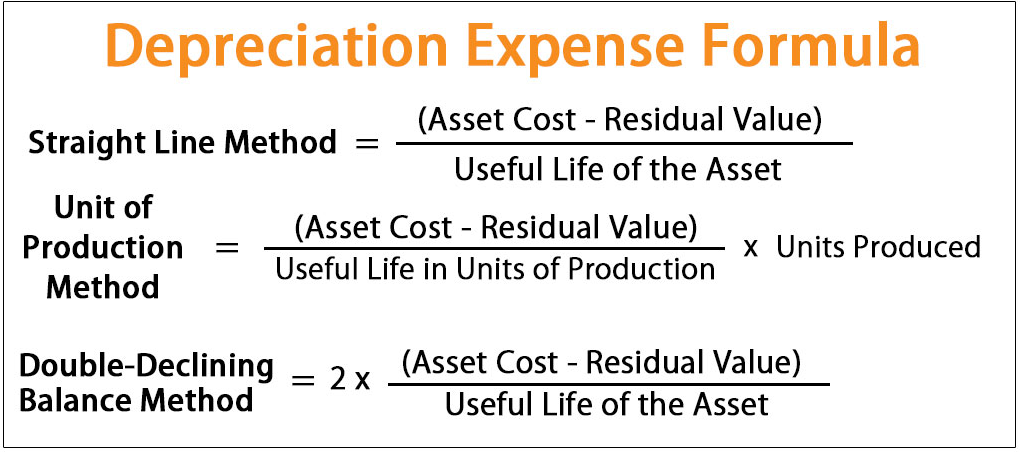

How To Calculate Depreciation Expense

Depending on their preferences, companies are free to choose from several methods to calculate the depreciation expense. To keep things simple, we’ll summarize just the two most common methods:

- Straight-line Method – This takes an estimated scrap value of the asset at the end of its life and subtracts it from its original cost. This result is then divided by management’s estimate of the number of useful years of the asset. The company expenses the same amount of depreciation each year. Here is the formula for the straight-line method: Straight-line depreciation = (original costs of asset – scrap value)/estimated asset life

- Accelerated Methods – These methods write-off depreciation costs more quickly than the straight-line method. Generally, the purpose behind this is to minimize taxable income. A popular method is the ‘double declining balance,’ which essentially doubles the rate of depreciation of the straight-line method: Double Declining Depreciation = 2 x (original costs of asset – scrap value / estimated asset life).

Depreciation Expense Formula

As an investor, you need to know how the choice of depreciation method affects an income statement and balance sheet in the short term.

Here’s an example. Let’s say The Tricky Company purchased a new IT system for $2 million. Tricky estimates that the system has a scrap value of $500,000 and that it will last 15 years. According to the straight-line depreciation method, the calculation for Tricky’s depreciation expense in the first year after buying the IT system is as follows:

\frac{(\$2,000,000 – \$500,000)}{15} = \$100,000

According to the accelerated double-declining depreciation, Tricky’s depreciation expense in the first year after buying the IT system would be this:

\begin{aligned} 2 \times \text{straight line rate} &= 2 \times \left( \frac{(\$2,000,000 – \$500,000)}{15} \right) \\ 2 \times \text{straight line rate} &= \$200,000\\ \end{aligned}

So, the numbers show that if Tricky uses the straight-line method, depreciation costs on the income statement will be significantly lower in the first years of the asset’s life ($100,000 rather than the $200,000 rendered by the accelerated depreciation schedule).

That means there is an impact on earnings. If Tricky is looking to cut costs and boost earnings per share, it will choose the straight-line method, which will increase its bottom line.

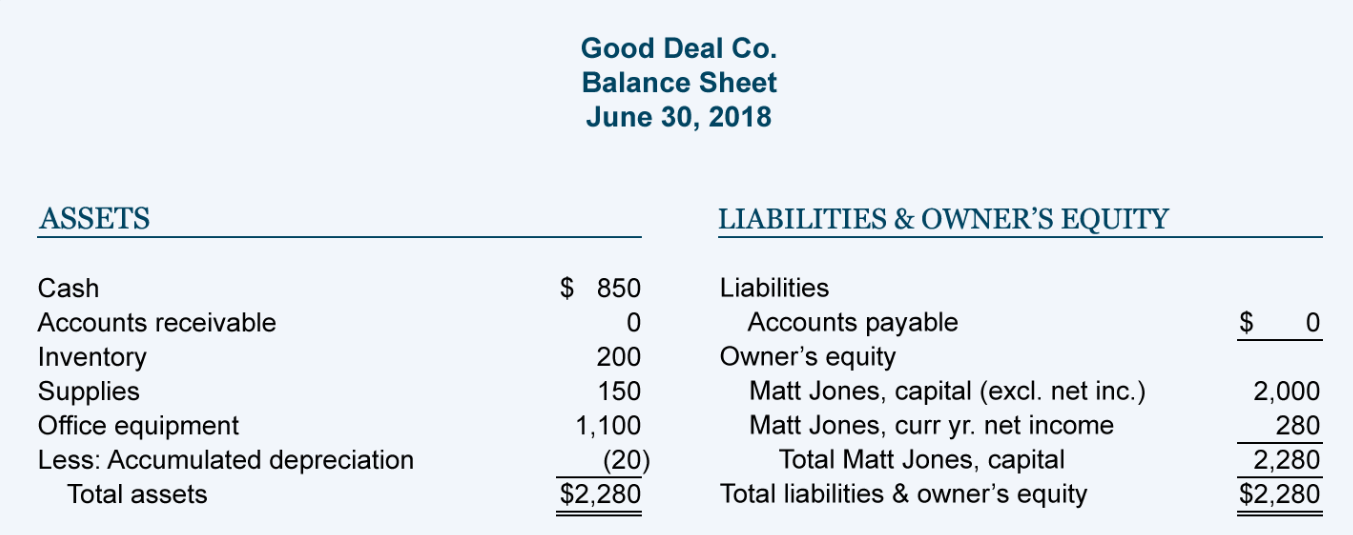

A lot of investors believe that book value, or Net Asset Value (NAV), offers a relatively precise and unbiased valuation metric. But, again, be careful. Management’s choice of depreciation method can also significantly impact book value: determining Tricky’s net worth means deducting all external liabilities on the balance sheet from the total assets—after accounting for depreciation. As a result, since the value of net assets doesn’t shrink as quickly, straight-line depreciation gives Tricky a bigger book value than the value a faster rate would give. (Learn more about these methods of depreciation in Depreciation: Straight-Line vs. Double-Declining.)

What Is Depreciation Expense

Depreciation is an accounting process by which a company allocates an asset’s cost throughout its useful life. In other words, it records how the value of an asset declines over time. Each time a company prepares its financial statements, it records a depreciation expense to allocate a portion of the cost of the buildings, machines or equipment it has purchased to the current fiscal year.

The purpose of recording depreciation as an expense is to spread the initial price of the asset over its useful life. For intangible assets—such as brands and intellectual property—this process of allocating costs over time is called amortization. For natural resources—such as minerals, timber, and oil reserves—it’s called depletion. (For background on reading financial statements check out What You Need To Know About Financial Statements.)

Depreciation Expense Journal Entry

The accounting for depreciation requires an ongoing series of entries to charge a fixed asset to expense, and eventually to derecognize it. These entries are designed to reflect the ongoing usage of fixed assets over time.

Depreciation is the gradual charging to expense of an asset’s cost over its expected useful life. The reason for using depreciation to gradually reduce the recorded cost of a fixed asset is to recognize a portion of the asset’s expense at the same time that the company records the revenue that was generated by the fixed asset. Thus, if you charged the cost of an entire fixed asset to expense in a single accounting period, but it kept generating revenues for years into the future, this would be an improper accounting transaction under the matching principle, because revenues are not being matched with related expenses.

In reality, revenues cannot always be directly associated with a specific fixed asset. Instead, they can more easily be associated with an entire system of production or group of assets.

The journal entry for depreciation can be a simple entry designed to accommodate all types of fixed assets, or it may be subdivided into separate entries for each type of fixed asset.

The basic journal entry for depreciation is to debit the Depreciation Expense account (which appears in the income statement) and credit the Accumulated Depreciation account (which appears in the balance sheet as a contra account that reduces the amount of fixed assets). Over time, the accumulated depreciation balance will continue to increase as more depreciation is added to it, until such time as it equals the original cost of the asset. At that time, stop recording any depreciation expense, since the cost of the asset has now been reduced to zero.