Marginal revenue is generated for each additional unit sold and is associated with a marginal cost (MC).

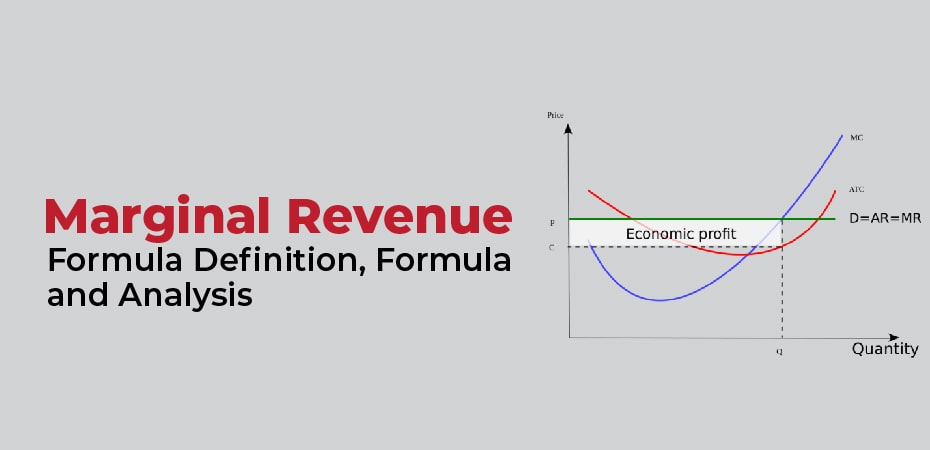

At a particular output level, marginal cost can remain constant. However, since it is subject to the law of diminishing returns, it will eventually slow down as output levels increase. Perfectly competitive firms will continue to produce output until marginal revenue equals marginal cost, according to economic theory.

Based on extra output units sold, businesses can analyze their marginal revenue to determine their level of earnings. Therefore, companies seeking to maximize profits must raise their production until marginal revenue equals marginal cost. Additionally, they may decide to cease production if a cost-benefit analysis shows that marginal revenue has fallen below marginal cost.

Understanding Marginal Revenue

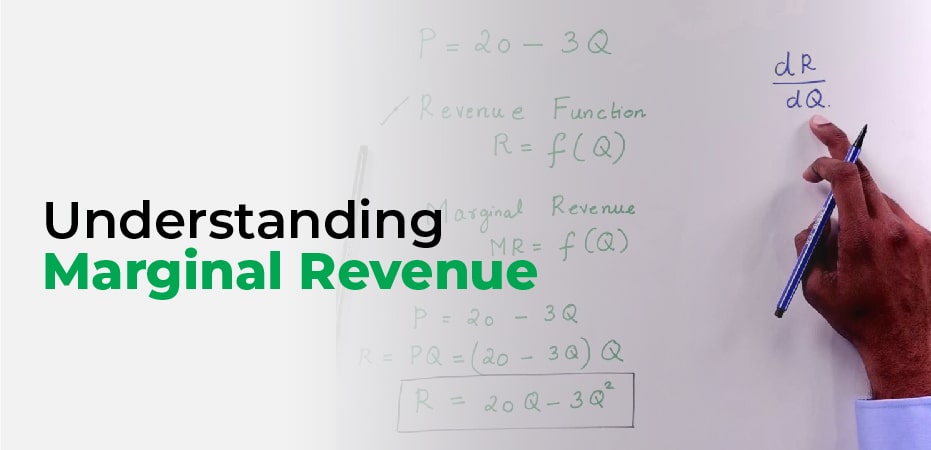

The change in total revenue divided by the change in total output quantity is how an organization calculates marginal revenue. The marginal revenue is therefore equal to the sale price of a single additional item. As an example, a company sells its first 100 products for $1,000. The marginal revenue of the 101st item will be $8 if it sells the next item for $8. The marginal revenue does not consider the previous average price of $10, as it only measures the incremental change.

Marginal benefits are achieved by adding an additional activity unit. Profits from new items are generated when marginal revenue exceeds marginal cost. When production and sales are continued until marginal revenue equals marginal cost, the company experiences the best results. After that point, the cost of producing an additional unit will exceed the revenue generated. As marginal revenue falls below marginal cost, firms typically apply the cost-benefit principle and stop production, since additional production brings no further benefits.

Marginal revenue can be calculated as follows:

- Marginal Revenue = Change in Revenue / Change in Quantity

Example of Marginal Revenue

The revenue schedule outlines both the total revenue earned and the incremental revenue for each unit in order to assist with the calculation of marginal revenue. A revenue schedule starts with a column listing the projected quantities demanded in increasing order, and a second column lists the market price. Three columns represent projected total revenues, based on these two columns.

The marginal revenue of producing at the quantity demanded on the second line is the difference between the total projected revenue of one quantity demanded and the total projected revenue from the line below it. For instance, 10 units sell for $9 each, resulting in complete revenues of $90; 11 units sell for $8.50, resulting in total revenues of $93.50. Therefore, the marginal revenue of the 11th unit is $3.50 ($93.50 – $90).

Margin Analysis

In our example, you can see that the marginal revenue definition is a fairly simple concept. It does, however, have a significant impact on product pricing and production levels based on the manufacturer’s industry and product.

In an environment of true competition, in which manufacturers sell mass-produced, homogeneous products at the market price, the marginal revenue is equal to the market price. In other words, manufacturers of commodities with little differentiation will always sell their products at the market price since it’s a competitive market. Consumers would switch to another company if their prices increased. This would be like a corn farmer switching to another company. Each year, corn prices are determined by the market. Because there is no difference between his product and theirs, consumers will purchase corn from their competitors.

In low output or highly specialized industries, the opposite is true. The selling price of a product is affected by the production level of the company since there are fewer alternatives. Therefore, less supply will increase demand and make consumers more willing to pay higher prices. A company has to keep its marginal revenue product within the constraints of the price elasticity curve but can adjust its output and pricing structure to optimize profitability.

What is the purpose of calculating marginal revenue for your business?

A profit-maximizing firm focuses on increasing its net earnings and proving its profitability to investors. As a result, they concentrate on increasing their bottom line with each sale because they usually have stable sales revenue flows. For this, they need to identify their profit maximization point and track their marginal revenue.

Understand the revenue impact of every extra unit sold

A higher total revenue, marginal revenue, profitability, and additional costs resulting from selling extra units of a product or service. Therefore, marginal revenue is essential to understand because it measures the revenue increment from selling more products and services.

Marginal revenue is subject to the law of diminishing returns, which states that if production increases, output increases less. In other words, the company has reached its maximum capacity.

Additional units cost money to produce and sell, and a company will make money as long as its marginal revenue remains above its marginal cost. In the point where MR equals MC, producing or selling more units does not make sense.

Understanding the relationship between market demand and sales

Companies use marginal revenue to analyze the relationship between sales, market demand, and market competition. Customers purchase what they want, whereas companies purchase what they need. Growth and profitability come from understanding how the two are intertwined.

A market demand represents the products and services your customers desire and are willing to buy, and a sale represents the products and services they purchase.

At all output levels, marginal revenue equals product price in a perfectly competitive market. A firm, as a price taker, can sell as many products or services as it wants at a given price, and price reductions are not necessary to increase sales.

Market types such as monopolistic, oligopolistic, and monopolistic competition will experience decreased marginal revenues with increased production. This is because they need to reduce prices to increase sales. As a result, marginal revenue may drop to negative levels.

Profit maximization

For businesses to maximize profits, they have to keep producing more output so long as each additional unit adds more to revenue than cost.

Additional revenue is marginal revenue, while additional cost is marginal cost. As a result, companies should continue to produce until marginal revenue equals marginal cost. If a company reaches the profit maximization point (MC = MR), it cannot make any more profit, so it should stop production.