Benefits of Being a Credit Analyst

One major advantage to being a credit analyst is that you are not limited to a particular type of company. A credit analyst does not have to work only for a bank or credit rating agency.

A credit analyst can work for any company that offers financing for its products and services. This means that a credit analyst can work with an automobile manufacturer, retail store, utility or even an energy company.

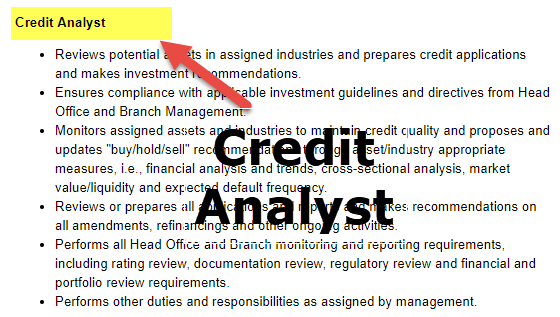

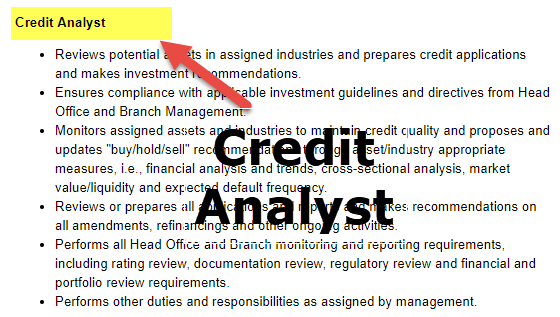

Credit Analyst

Credit analyst is a job that comes with lots of responsibility. Generally, a credit analyst is responsible for assessing a loan applicant’s creditworthiness. Depending on the area in which a credit analyst chooses to work, these applicants could be individuals or companies. Credit analysts are typically employed by commercialand investment banks, credit card issuing institutions, credit rating agencies and investment companies. Read on to find out if shouldering this kind of responsibility is for you.

Credit Analyst’s Job

A credit analyst is responsible for gathering and analyzing financial data about clients, including paying habits or history, earnings and savings information, and purchase activities.

After the data has been gathered, a credit analyst evaluates the data and recommends a course of action for the customer. For example, a credit analyst who works with a bank or organization that issues credit cards collects data about clients who have defaulted in their payments. After analyzing the data, the analyst might recommend closing the card or reducing the credit line. Credit analysts are not limited to clients who have defaulted in their payments. A credit analyst can also be responsible for potential customers seeking new credit or customers who are being considered for credit line extensions.

Credit Analyst’s Educational Requirements

The minimum educational requirement for the position of credit analyst is a bachelor’s degree in finance, accounting or another related field. A bachelor’s degree in finance or accounting exposes you to subjects like basic accounting and finance, statistics, ratio analysis, calculus, economics, Industry assessment and financial statement analysis. These subjects are necessary to function as a credit analyst because they aid in risk assessment. Educational subjects like industry and ratio analysis are necessary because part of assessing the risk for a company includes assessing its environment.

While having a bachelor’s degree in a finance-related field comes in very handy, some companies do not require it. Some banks and companies provide on-the-job training to credit analysis employees who do not have finance-related degrees. On most occasions, these companies require some work experience in an accounting/finance-related field or a graduate degree in a business-related field. Depending on the level of the job, a company might require a credit analyst to have a Chartered Financial Analyst (CFA) designation.

Credit Analyst’s Other Required Skills

Some other skills that a credit analyst must possess include the following:

- Diligence: This is the ability to pay great attention to detail. As a credit analyst, any piece of information or data that is missed can lead to an incorrect analysis of a customer and may cause potentially costly problems for the client involved.

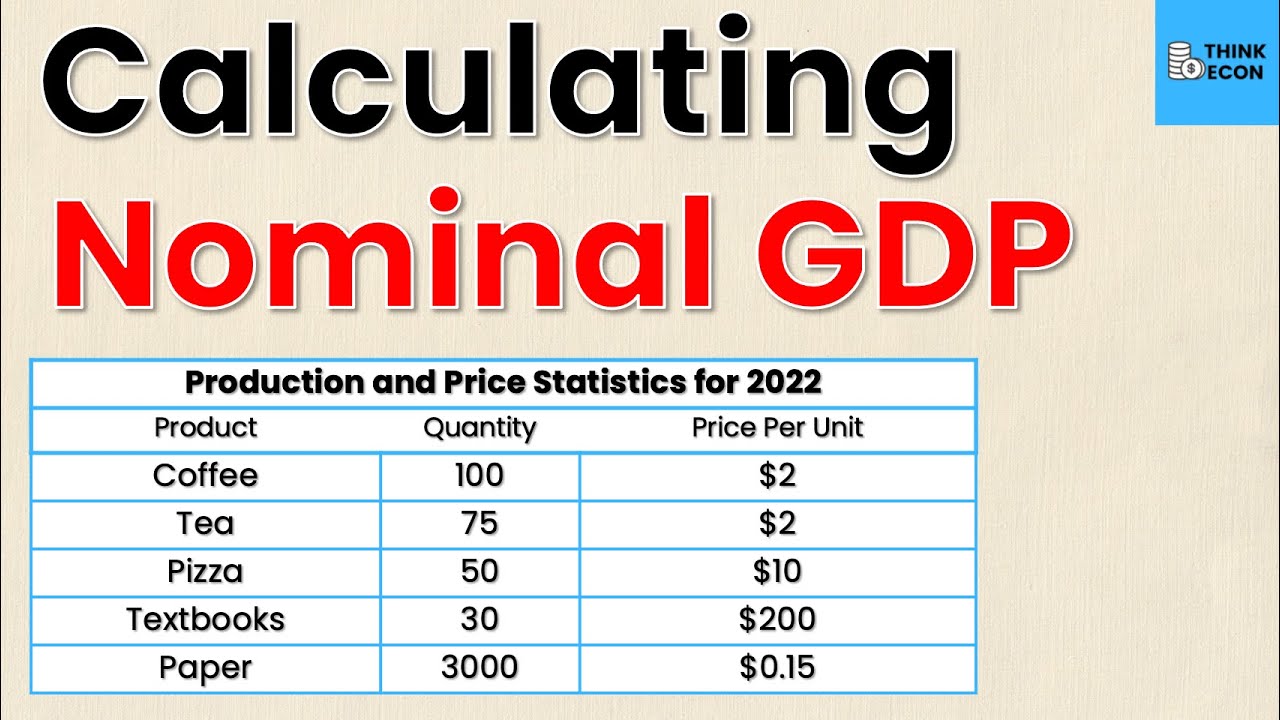

- Quantitative Analysis Skills: A credit analysis has to be able to look at or create a set of numbers and be able to know what they mean for each particular client.

- Written and Oral Communication Skills: A credit analysis must be able to effectively disseminate decisions to a variety of people, either orally or in print. Coming up with a solution to a problem is of little use if you cannot effectively communicate it to others.

- Knowledge of Industries: Sometimes a credit analysis is assigned to work with companies and firms that operate in a particular industry. For this reason, a great understanding of the ins and outs of a particular industry can come in handy. If you don’t know many industries, just be sure to do your research before you show up for an interview.

- Multitasking and Prioritization Skills: A credit analyst needs to be able to work on different projects at once and prioritize projects effectively. This is because a credit analysis might be assigned to work with different clients at the same time.

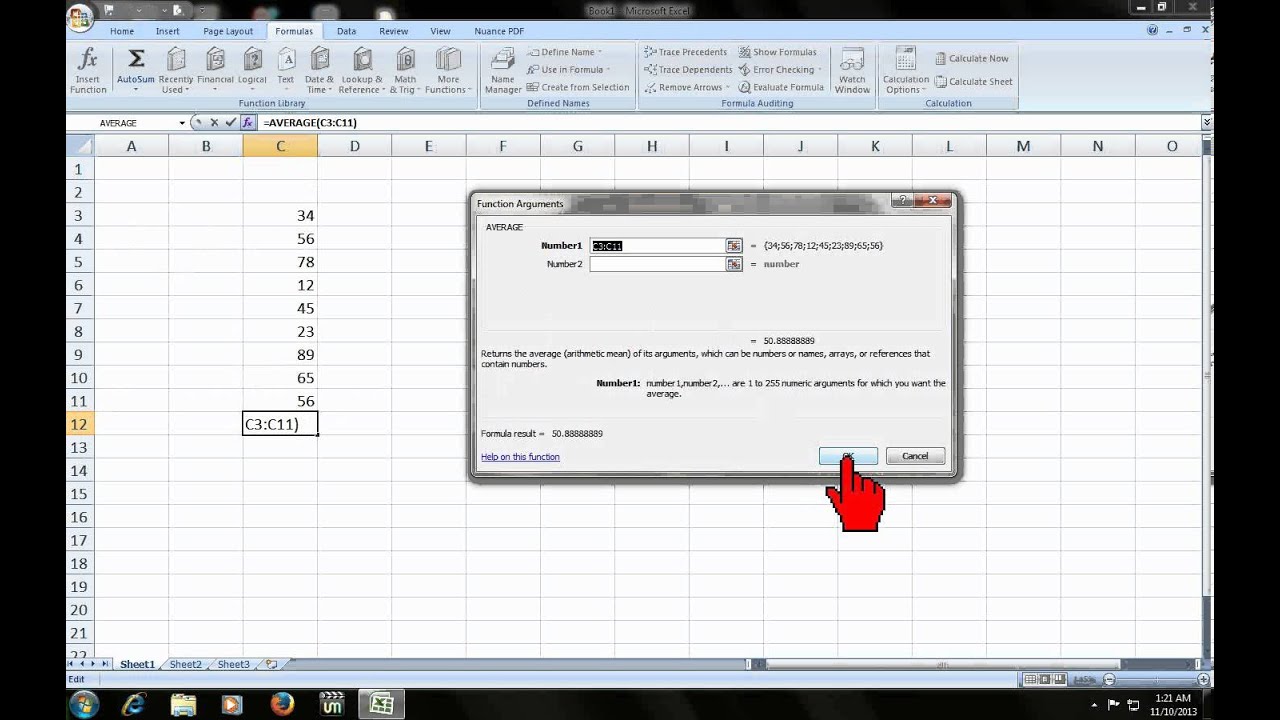

- Experience with Financial Software: A credit analysis has to be comfortable with some software like Microsoft Excel and its various features and other financial software used to analyze numerical data.

Credit Analyst’s Salary

Another benefit of being a credit analysis is that it can lead to higher and exciting career paths like investment banker, portfolio manager and loan and trust manager. And, according to Salary.com’s info for 2019, an average credit analyst with a bachelor’s degree earns between approximately $44,000 and $55,000, which is a pretty solid wage in this sector.